Will the South African Reserve Bank’s Monetary Policy Committee (MPC) choose a hawkish or dovish stance in its upcoming interest rate decision on 20 July? This decision comes as the SARB has been implementing consecutive rate hikes since November 2021, aiming to bring down South Africa’s persistent inflation within the target range of 3% to 6%.

During this hiking cycle, the MPC has implemented ten consecutive rate hikes, ranging from 25 to 75 basis points. These cumulative hikes total 475 basis points since November 2021, pushing the repo rate to 8.25% – a level last seen during the 2009 global financial crisis.

Until recently, the SARB’s efforts to control inflation were largely ineffective, as prices continued to rise. Stubborn food and fuel inflation contributed to headline consumer price inflation (CPI) reaching its highest level in a decade.

However, a positive shift occurred in April 2023 when the annual headline CPI dropped below 6.9% for the first time in 11 months. Inflation continued to cool in May, with headline CPI decreasing to 6.3%.

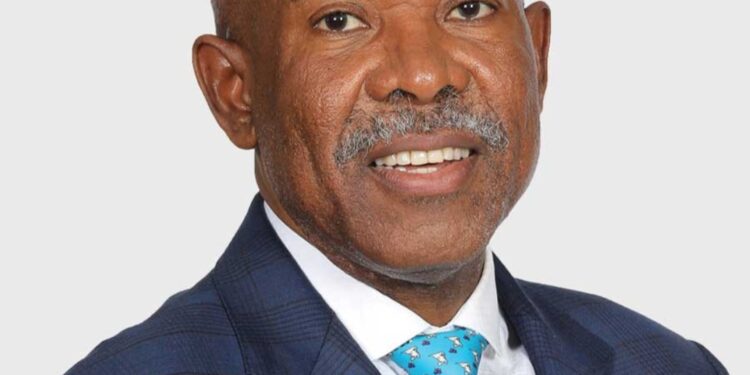

SARB governor Lesetja Kganyago expressed satisfaction with the progress made in curbing rising prices and emphasized the central bank’s commitment to maintaining control over inflation. He stated that the objective is to see inflation decline and eventually reach the target range.

Kganyago recently indicated that the Reserve Bank expects inflation for June to be below 6% and anticipates an average inflation rate of 6% or slightly below for 2023.

In contrast to the SARB’s hiking cycle, the US Federal Reserve, which has also implemented ten consecutive rate hikes, recently decided to pause its cycle that began in March 2022.

While the cooling inflation and the Fed’s pause might suggest positive news for the MPC’s decision in late June, some experts believe that the hiking cycle is not yet over.

Daily Investor sought predictions from four experts regarding the interest rate outcome for the July MPC meeting. Most experts agreed that a 25 basis point increase is likely, but acknowledged that this meeting presents a challenging decision.

Senior economist Christie Viljoen from PwC South Africa proposed the possibility that the interest rate hiking cycle may have concluded. Viljoen’s viewpoint is based on the SARB’s forecast, indicating interest rates peaked in May. Additionally, the April and May headline inflation rates of 6.8% and 6.3% respectively suggest that inflation will approach the SARB’s forecast of 6.4% for Q3 2023.

Viljoen stated, “With inflation slowing and likely to drop to 5.5% year-on-year by year-end, the SARB is well on its way to soon achieving the real (i.e., inflation-adjusted) repo rate of 2.5% it desires.”

Kim Silberman, an economist and macro-strategist at Matrix Fund Managers, expects the MPC members to have differing opinions on the upcoming policy rate decision. She noted that Kganyago referred to the country’s monetary policy as restrictive after the 50 basis point hike in May, indicating potential room for the committee to pause. However, Silberman believes that those favouring a 25 basis point hike might outnumber those in favour of pausing.

Although CPI is expected to fall below 5.5% year-on-year in June due to base effects, this data will only be released after the meeting. Silberman anticipates that the SARB will consider rate cuts when global monetary policy starts positioning for a deflationary environment in the second half of 2023.

Dawie Roodt, the chief economist at Efficient Group, described the July MPC meeting as a challenging decision. He mentioned that the Federal Reserve paused its rate hikes for one meeting but is likely to continue increasing rates by 25 or 50 basis points. Roodt suspects that the committee will opt for a 25 basis point increase.

Roodt emphasized that South Africa is approaching the upper turning point of interest rates, and the July hike could be the last or second-to-last in the cycle.

Wichard Cilliers, the director and head of market risk at TreasuryONE, believes the SARB will choose a 25 basis point interest rate hike based on prevailing economic conditions and market analysis. Cilliers stated that this potential move aims to address persistent inflationary pressures that exceed the SARB’s target band of 3% to 6%. Factors contributing to elevated inflation include sustained high food inflation and increased costs of importing fuel due to the depreciation of the rand.

Cilliers added that the SARB’s decision may also be influenced by the Fed’s intention to continue raising interest rates, making the SARB reluctant to refrain from taking similar action.